Global Tracker Mounting System Rankings Released, Chinese Companies Gain Momentum in Overseas Markets

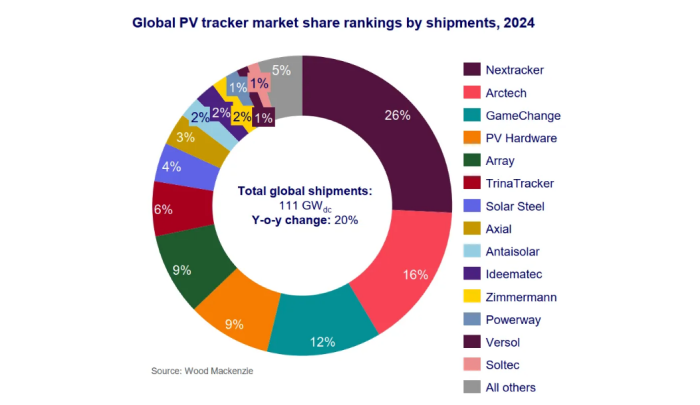

Recently, global consulting firm Wood Mackenzie released the "2025 Global Tracker Market Report", providing statistics on the global tracker shipments in 2024, along with the market performance and rankings of major tracker companies across different regions.

Global Tracker Shipments Surpass 100 GW for the First Time

In 2024, global tracker shipments grew by 20% year-on-year, reaching 111 GW, marking the first time global shipments exceeded the 100 GW threshold. Arctech (中信博) and TrinaTracker (天合跟踪) remained in the global top ten tracker suppliers, with Arctech climbing to the second position. India was Arctech’s largest market, accounting for nearly half of its total shipments. TrinaTracker maintained its sixth place globally, ranking fourth in key regions such as Europe, Latin America, the Middle East, and Asia-Pacific. It also stood out as the only Chinese company among the top five suppliers in both Europe and Latin America.

Figure 1: Global Tracker Supplier Shipments Ranking, 2024

Europe Sees Steady Growth Amid Fierce Competition

Europe’s tracker market continued to grow steadily, with 22.953 GW shipped in 2024. As a key target region for U.S. tracker companies and home to many local tracker manufacturers, Europe remains the most competitive market among top-tier companies.Nextracker (USA) led the market with a 14% share,TrinaTracker ranked fourth with a 10% market share, becoming the highest-ranking Chinese supplier in European history TrinaTracker previously stated that the company focuses on high-value markets, prioritizes technological innovation and high-quality development, and is committed to offering all-scenario intelligent tracking solutions. Recently, TrinaTracker’s smart tracking technology was awarded the Silver Medal of the 25th China Patent Award, the highest recognition in intellectual property within the PV industry to date.

Strong Growth in the Middle East and Asia-Pacific; Chinese Companies Dominate

The Middle East and Asia-Pacific regions experienced significant tracker market growth in 2024:Middle East: 2024 shipments reached 15.4 GWArctech ranked first,TrinaTracker ranked fourth. In February 2025, TrinaTracker announced the construction of a 3 GW factory in Saudi Arabia, along with several major orders:1 GW in Saudi Arabia 900 MW in the UAE. These projects signal the company’s intensified focus on developing the Middle East market in 2025.Asia-Pacific: Total shipments reached 25 GWIndia led with 15.8 GW, becoming the largest market in the region. Arctech ranked first in Asia-Pacific, shipping 7.6 GW to India, with a 48% market shareTrinaTracker, not operating in India, ranked fourth in the region

China Accounts for 3% of Global Tracker Shipments; Domestic Demand May Surge Under New Policy

China’s tracker installations in 2024 were 3.604 GW, a 13% decrease from 2023, accounting for only 3% of global installations. However, with the implementation of Policy Document No. 136, China has entered a fully market-driven electricity trading era. This could trigger a surge in domestic tracker demand in 2025.

Trackers have been globally recognized for improving the return on investment in PV power plants. Despite only 3% penetration in China, global tracker penetration stands around 40%, with over 80% in the U.S., Middle East, and Latin America.

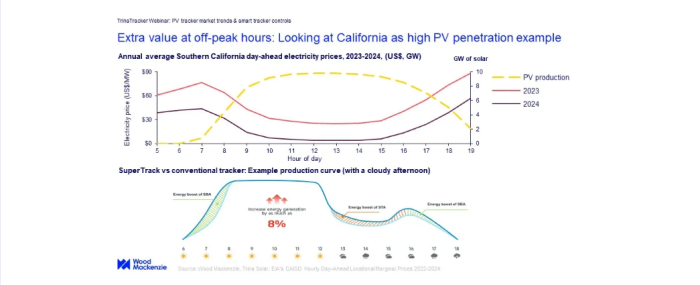

On the technological front, AI-powered tracking has matured, enabling further energy yield increases. Nextracker and TrinaTracker have both published empirical results of their self-developed AI tracking algorithms, showing an additional 2–4% power generation on top of standard tracking, primarily during morning and evening hours.

Real-world Data Confirms Tracker Advantage

On May 16, the 2024 annual data release of the National PV and Energy Storage Experimental Platform (Daqing Base), operated by SPIC Huanghe Company, was held in Beijing. Data revealed that:

Single-axis trackers generate 15.9% more electricity than fixed-tilt systems

Trackers performed significantly better during local peak hours

Source: Wood Mackenzie